The ROI of AI: 75% of projects fail. Build a business case that works

The data is in. AI can deliver $3.70 for every dollar invested. But 75% of initiatives never reach that potential. The difference between the winners and the rest comes down to one thing most companies skip: a proper business case and a thorough value hypothesis.

What this article will help you do

If you are responsible for AI investment decisions, or tasked with building the case for one, this article is for you. It cuts through the noise and gives you three things: a clear picture of what the latest research says about AI returns (the good and the bad), an honest breakdown of why most initiatives never pay off, and a practical path to building a business case that actually gets through the boardroom.

We wrote this because we keep having the same conversation. A CTO or CDO knows AI matters. Their board is asking questions. Competitors are moving. But nobody can put a credible number on the table. The result is either paralysis or, worse, a big investment with no financial foundation underneath it. Both of those outcomes are avoidable.

The gap between AI spending and AI returns

Nearly every company is investing in AI, and the vast majority are not getting what they expected.

McKinsey's 2025 State of AI report found that 88% of organisations now use AI in at least one business function. The appetite is clearly there. But IBM's 2025 CEO Study, which surveyed 2,000 chief executives across 33 countries, tells the other half of the story: only one in four AI initiatives delivered the expected return on investment.

MIT's "GenAI Divide" report puts the challenge in even sharper terms. Across the organisations they studied, 95% of generative AI pilots failed to show measurable impact on the bottom line.

The potential, though, is real. IDC research from early 2025 estimates that companies getting AI right see $3.70 back for every dollar spent. So the technology is not the issue. The gap between what AI can do and what most companies actually get from it comes down to preparation. Specifically, whether there was a proper business case before the money started flowing.

Why most AI initiatives fail

Line up the research from IBM, MIT, BCG and S&P Global, and the same patterns keep surfacing. The technology is rarely the problem. Comprehension and architecture are.

Starting with the technology instead of the problem. This is the single most cited cause of failure. Companies pick a tool or model and then go looking for something to apply it to. IBM's Marina Danilevsky described the typical approach as: step one, we are going to use large language models; step two, what should we use them for? That sequence guarantees waste.

Poor data quality. A 2025 study on data quality and machine learning performance measured nearly a 10 percentage-point decline in model accuracy at just 20% data pollution. That pattern held across different types of AI tasks. If your data is messy, your AI will be unreliable. And unreliable AI erodes the organisational trust you need for anyone to actually adopt it.

Spending in the wrong places. MIT's research found that more than half of generative AI budgets go towards sales and marketing tools. The highest returns, however, sit in back-office automation. Companies keep funding the most visible use cases while ignoring the ones that actually pay for themselves.

Lack of executive alignment. AI projects with genuine C-suite sponsorship and cross-functional governance succeed at dramatically higher rates. Digital Applied's 2026 enterprise AI framework found that executive alignment reduces project failure by 67%. Without it, projects lose priority, budgets get questioned, and promising pilots get stuck indefinitely, never making it to production.

Measuring the wrong things. UC Berkeley's Sutardja Center offered a provocative reframe of MIT's 95% failure stat. Their argument: this is not an AI failure but a measurement failure. Most organisations apply traditional software payback expectations to a technology that behaves completely differently. Enterprise transformation needs longer timescales and different metrics. Getting the measurement wrong does not just undercount value. It kills projects that would have succeeded with more patience.

What the winners do differently

If three out of four initiatives are falling short, what separates the one in four that works?

BCG's 2025 CFO study found clear patterns among high-performing teams. They go after quick wins rather than open-ended experimentation. They set a dedicated AI budget rather than pulling from general transformation funds. And they track progress from day one rather than hoping the value will become obvious later.

MIT's research highlighted another factor that matters especially for mid-market companies. Organisations that work with sp

ecialised partners succeed roughly twice as often as those that try to build everything internally. You do not need a deep bench of data scientists. In fact, the data suggests you are better off without one if the alternative is a focused external partnership.

McKinsey's findings reinforce the importance of workflow redesign. Many companies bolt AI onto existing processes and expect transformation. The ones seeing real impact are changing how work gets done, not just accelerating the old way of doing things.

The common thread across all of this research is that the winners treat AI as a transformation programme, not a technology project. They embed it into the broader operational or financial change they are already driving. That integration is what turns scattered pilots into compounding returns.

How to calculate AI ROI

The formula itself is simple. ROI equals the net gain from the AI investment divided by the total cost, multiplied by 100. The hard part is modelling both sides honestly.

On the returns side, a strong business case needs to go well beyond cost savings. It should capture the full range of value AI creates, grounded in your actual operational data rather than industry averages. It comes down to the following:

What you gain. Direct cost savings, productivity, revenue acceleration. The obvious ones everyone models.

What you lose by waiting. Competitive erosion, talent loss to AI-mature competitors, rising cost of late adoption. ROI is not just upside; it is also the price of standing still.

What you avoid. Regulatory exposure, compliance costs, operational risk from manual errors. Consistently underweighted in most business cases.

How value compounds. AI gets better over time as it learns and adoption deepens. Most models are static snapshots. The real returns accelerate in year two and three.

Where freed capacity goes. Time saved only counts if it gets redirected to higher-value work. A dimension that captures what people do with the hours they get back is more realistic and more sellable to leadership than headcount reduction.

What connects to what. Standalone AI tools plateau. Value multiplies when AI spans systems and workflows, with data from one process feeding the next.

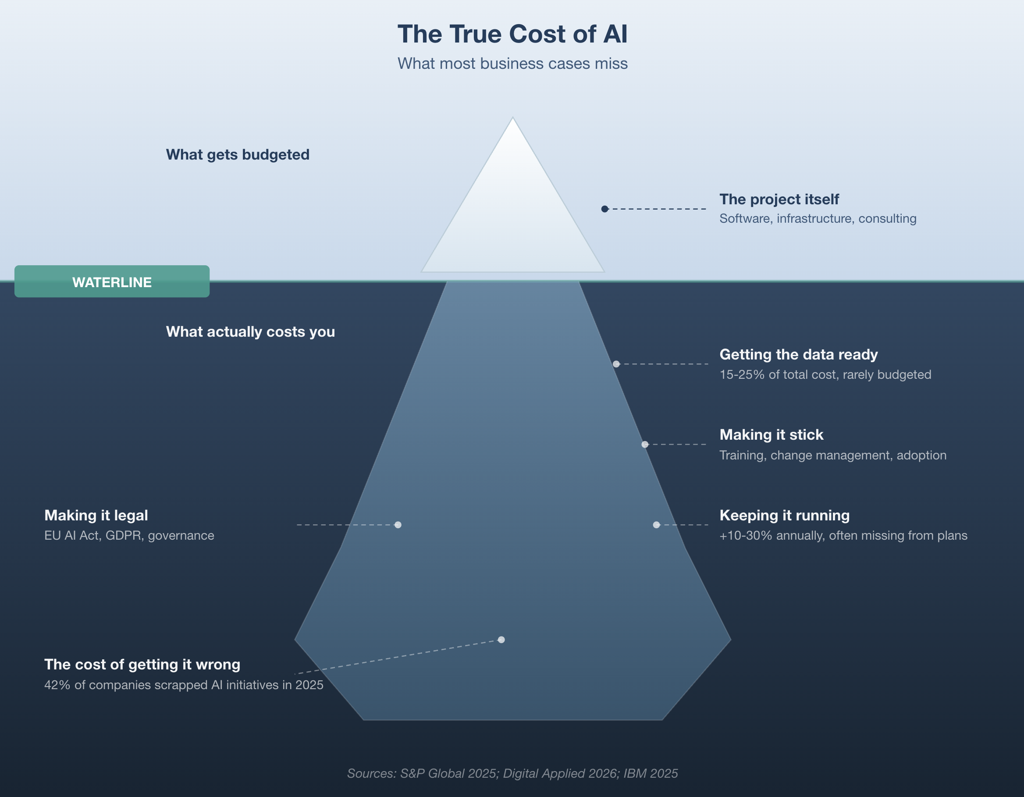

On the cost side, most business cases significantly underestimate the true investment. The obvious line items are rarely the problem. What catches organisations off guard is everything around them:

The project itself. Software, infrastructure, implementation, consulting. The line items everyone remembers to budget.

Getting the data ready. Cleaning, structuring, labelling, migrating. Accounts for 15% to 25% of total cost but shows up in fewer than a third of initial budgets. This is where most surprises hit.

Making it stick. Training, change management, new ways of working. The technology lands but nobody uses it properly because the organisation was not prepared. This cost is almost always underestimated.

Keeping it running. Cloud inference fees, model retraining, monitoring, security patching. Ongoing costs that add 10% to 30% annually and rarely appear in the original business case.

Making it legal. Governance frameworks, compliance audits, data residency, EU AI Act and GDPR alignment. Especially relevant for European companies where the regulatory landscape is tightening fast.

The cost of getting it wrong. Failed pilots, wasted vendor contracts, internal credibility damage, opportunity cost of teams tied up on projects that go nowhere. S&P Global found that 42% of companies scrapped most of their AI initiatives in 2025. That money does not come back.

Building a business case that gets through the boardroom

A solid ROI model is necessary but not enough on its own. The business case also needs to match how executives actually make decisions.

Present at least three value drivers. Even when one driver looks strong enough on its own, build the case on three. Leadership discussions tend to discount the headline number. When your primary benefit gets challenged or halved, the other two keep the overall case above the threshold.

Connect short-term wins to long-term value. Show clear cost savings or revenue improvement within the first 6 to 12 months. Then model how those gains compound over 18 to 36 months as the AI learns, adoption grows, and workflows get reshaped around new capabilities.

Address governance and risk directly. The EU AI Act imposes penalties of up to 20 million euros or 4% of global revenue for non-compliance. A business case that ignores regulatory risk signals a lack of seriousness to any executive who understands the European landscape.

Give the intangibles their own space. Customer satisfaction, employee engagement, decision speed, organisational learning. These are real outcomes. They may not belong in the core ROI number, but they should have their own section. For a board member focused on retention or customer experience, an NPS shift might tip a borderline decision on its own.

The cost of standing still

The business case for AI is not only about the upside of investing. There is a real cost to waiting.

BCG's 2025 research paints a picture of a market splitting in two. A small group of companies are investing with clear direction, building data advantages, and pulling away. The majority are still experimenting without focus. Every quarter of inaction widens that gap. Competitors building compounding advantages in efficiency and market responsiveness are not going to slow down while your organisation catches up.

The question is not whether you will adopt AI. It is whether you do it on your terms, with a clear financial picture, or scramble to catch up later at a much higher cost.

Where the returns are highest by function

Not every AI use case delivers equally. Where you deploy matters as much as how.

Back-office operations consistently deliver the highest returns relative to investment, yet remain the most underfunded area. MIT found that successful back-office implementations generate $2 million to $10 million annually in cost reductions.

Customer service is one of the most proven and accessible starting points, with multiple studies pointing to around 30% cost reductions through AI-driven analysis and response improvement.

Finance and accounting is seeing rapid uptake. BCG's 2025 CFO study found that more than half of surveyed teams already use AI in statutory accounting and treasury, with risk management and forecasting delivering the strongest results.

Software development has seen the fastest shift. Ninety percent of developers now use AI tools, with research consistently showing tasks completed roughly 25% faster.

Supply chain results are solid and consistent, with 41% of companies deploying AI in this area reporting cost reductions of 10% to 19%.

Marketing shows strong combined impact on both cost and revenue. But MIT cautions that marketing is also where spending tends to be overstated relative to actual returns, especially compared to back-office alternatives.

From business case to implementation: closing the gap in 3 weeks

Most organisations we speak with are stuck in one of two places. Either there is no business case, which means every AI conversation stays theoretical and no budget gets approved. Or someone has spent months on an internal analysis that is already stale by the time it reaches the boardroom.

Both roads end in the same place: delayed decisions, wasted money, or both.

We solve this. We deliver a comprehensive AI ROI business case in 3 weeks. Not a template. Not a deck of industry averages. A quantified, defensible case built around your operations, your data, and your priorities.

Week 1: Discovery and baselining. We map your operations, identify the highest-value use cases, and establish the baseline metrics that the entire ROI model depends on. This includes an honest look at data readiness, integration complexity, and governance requirements.

Week 2: Financial modelling and risk assessment. We build the quantified business case, model total cost of ownership including the hidden costs that blow up budgets, and map regulatory risk across the EU landscape.

Week 3: Executive-ready deliverable. You get a presentation-ready business case with clear value drivers, a phased implementation roadmap, and an honest risk assessment that builds boardroom confidence rather than undermining it.

MIT's research confirms that specialised partners succeed roughly twice as often as internal builds. Getting the business case right before committing to full implementation is one of the highest-return decisions a company can make.

The bottom line

AI works, but only when you know what you are solving for, what it will cost, and what you will get back. Three out of four companies skip that step and pay for it later. The ones that get it right invest a fraction of the cost upfront to build the financial clarity that makes everything after it faster, cheaper, and defensible.

We deliver your comprehensive AI ROI business case in 3 weeks. Quantified profit projections. Honest cost modelling. An executive-ready deliverable your board can sign off on. No drawn-out studies. No off-the-shelf frameworks. Built around your operations, your data, and your priorities.

If your organisation is considering an AI investment, or struggling to prove the value of one already in flight, reach out to us. A short conversation is all it takes to find out where the real returns are and how to build the case that gets them approved.

Frequently Asked Questions

What is the average ROI of AI? IDC research estimates that generative AI delivers $3.70 for every dollar invested. However, this figure varies enormously depending on approach. IBM found that enterprise-wide AI initiatives averaged just 5.9% ROI, while targeted implementations in areas like back-office automation can generate $2 million to $10 million annually.

How long does it take to see ROI from AI? Most organisations achieve satisfactory ROI within 2 to 4 years for enterprise-wide initiatives. However, focused implementations targeting specific workflows can demonstrate value within 6 to 12 months. BCG's research shows that teams focusing on quick wins from the start see meaningfully higher success rates.

Why do most AI projects fail? The five most common causes are: no clear business case tying AI to a defined business problem, poor data quality, misallocated budgets (spending on visible but low-ROI use cases), lack of executive alignment, and applying the wrong measurement frameworks. MIT estimates that 95% of generative AI pilots fail to show P&L impact.

How do you calculate AI ROI? The core formula is (Net Gain from AI Investment / Total Cost of AI Investment) x 100. A complete calculation should model five dimensions: time savings, error reduction, speed-to-revenue, capacity unlock, and competitive advantage. On the cost side, include data preparation (15% to 25% of total cost), integration, training, ongoing maintenance, and governance.

What is the biggest mistake companies make with AI? Starting with the technology instead of the business problem. IBM's research and multiple other studies confirm that companies choosing AI use cases based on ROI potential, rather than technological novelty, achieve significantly better outcomes.

How much should companies budget for AI? Benchmarks vary by industry. Retail companies allocate an average of 3.32% of revenue to AI. BCG's research shows that AI leaders commit 20% or more of their digital budgets to AI and invest 70% of AI resources in people and processes rather than technology alone. Financial services firms with over $5 billion in revenue invested an average of $22.1 million in AI in 2024.

References:

Primary Research Reports

- IBM Institute for Business Value / Oxford Economics (2025). CEO Study: AI Initiative Success Rates. Survey of 2,000 CEOs across 33 countries and 24 industries, conducted February-April 2025. Finding: 25% of AI initiatives delivered expected ROI; 16% scaled enterprise-wide.https://newsroom.ibm.com/2024-12-19-IBM-Study-More-Companies-Turning-to-Open-Source-AI-Tools-to-Unlock-ROI

- MIT NANDA Initiative (2025). "The GenAI Divide: State of AI in Business 2025." Finding: 95% of generative AI pilots fail to deliver measurable P&L impact; 5% of custom enterprise AI solutions reach production.https://fortune.com/2025/08/18/mit-report-95-percent-generative-ai-pilots-at-companies-failing-cfo/

- McKinsey / QuantumBlack (2025). "The State of AI in 2025: Agents, Innovation, and Transformation." Survey of 1,993 respondents across 105 countries. Finding: 88% use AI in at least one function; only 39% report EBIT impact.https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai

- BCG Center for CFO Excellence (2025). "How to Get ROI from AI in the Finance Function." Survey of 280+ finance executives, March 2025. Finding: median reported ROI of 10%; quick-win focus increases success by 6 percentage points.https://www.bcg.com/publications/2025/how-finance-leaders-can-get-roi-from-ai

- BCG (2024). "Where's the Value in AI?" Global study of 1,000+ companies. Finding: 4% have cutting-edge AI capabilities generating substantial value; 74% have yet to show tangible results.https://media-publications.bcg.com/BCG-Wheres-the-Value-in-AI.pdf

- IDC / Microsoft (2025). GenAI ROI report. Finding: GenAI delivers estimated $3.70 return per dollar invested; adoption rose from 55% in 2023 to 75% in 2024.https://news.microsoft.com/en-xm/2025/01/14/generative-ai-delivering-substantial-roi-to-businesses-integrating-the-technology-across-operations-microsoft-sponsored-idc-report/

- S&P Global (2025). AI initiative abandonment data. Finding: 42% of companies scrapped most AI initiatives in 2025, up from 17% in 2024.Referenced via: https://beam.ai/agentic-insights/why-42-of-ai-projects-show-zero-roi-(and-how-to-be-in-the-58-)

- Digital Applied (2026). "Enterprise AI Adoption: ROI Framework Guide 2026." Finding: organisations using structured ROI frameworks see 3.5x average returns within 24 months; executive alignment reduces failure by 67%.https://www.digitalapplied.com/blog/enterprise-ai-adoption-roi-framework-2026

- Harvard Business School. AI productivity study. Finding: AI users completed tasks 25.1% faster with 40%+ higher quality.Referenced via: https://www.fullview.io/blog/ai-statistics

- Gallup (2024). US employee AI strategy survey. Finding: only 15% of employees report their workplace has communicated a clear AI strategy.Referenced via: https://www.fullstack.com/labs/resources/blog/generative-ai-roi-why-80-of-companies-see-no-results

- Dataiku / Harris Poll (2025). CEO survey on AI and job security. Finding: 74% of CEOs worry about losing their jobs within two years if they cannot prove AI ROI.Referenced via: https://lighthouselaunch.com/blog/ibm-ceo-study-ai-initiatives-roi-failure-rates-2025

- Gartner (2024). Press release, July 2024. Prediction: 30% of generative AI projects abandoned after proof of concept by end of 2025.Referenced via: https://www.bdo.com/insights/advisory/genai-and-roi-building-the-business-case

- Mercer. AI competitiveness study. Finding: 54% of business leaders believe their companies will not remain competitive beyond 2030 without AI at scale.Referenced via: https://aristeksystems.com/blog/whats-going-on-with-ai-in-2025-and-beyond/

- UC Berkeley Sutardja Center for Entrepreneurship and Technology (2025). "Beyond ROI: Are We Using the Wrong Metric in Measuring AI Success?" Analysis arguing 95% failure rate reflects measurement failure, not AI failure.https://exec-ed.berkeley.edu/2025/09/beyond-roi-are-we-using-the-wrong-metric-in-measuring-ai-success/

- Goldman Sachs. Generative AI global productivity estimate. Finding: AI could boost global productivity by $7 trillion annually by 2030.Referenced via: https://thestrategystack.substack.com/p/ai-business-case-roi-risk-agentic-ai

- World Economic Forum (2025). "How CFOs Can Secure Solid ROI from Business AI Investments."https://www.weforum.org/stories/2025/10/cost-productivity-gains-cfo-ai-investment/

Industry-Specific Data Points

- Mastercard. AI fraud detection results. Finding: improved fraud detection by average 20%, up to 300% in specific cases.Referenced via: https://www.fullview.io/blog/ai-statistics

- McKinsey. Banking industry projections. Finding: 15-20% net cost reduction; potential for 30% as automation scales.Referenced via: https://www.fullview.io/blog/ai-statistics

- IBM. Customer service AI analysis. Finding: analysing calls, emails, and tickets with AI reduces costs by 23.5%.Referenced via: https://aristeksystems.com/blog/whats-going-on-with-ai-in-2025-and-beyond/

- BCG / Wellcome. Drug discovery AI impact. Finding: 25-50% time and cost savings in discovery-to-preclinical stage.Referenced via: https://www.fullview.io/blog/ai-statistics

- IBM Telco Customer Churn Dataset Study (2025). Data quality impact on ML performance. Finding: nearly 10 percentage-point performance drop at 20% data pollution.Referenced via: https://www.fullstack.com/labs/resources/blog/generative-ai-roi-why-80-of-companies-see-no-results

EU Regulatory References

-

- European Union AI Act. Penalty framework: up to 20 million euros or 4% of global revenue for non-compliance.Referenced via: https://www.legalitprofessionals.com/legal-it-columns/65-guest-columns/14139-from-risk-to-roi-the-business-case-for-ai-governance